private reit tax advantages

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

Restricted Stock Learn Accounting Finance Investing Accounting Basics

For example investing in.

. It receives the same tax treatment as those publicly traded but that is where most of the similarities end. Lets dive right in and. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios.

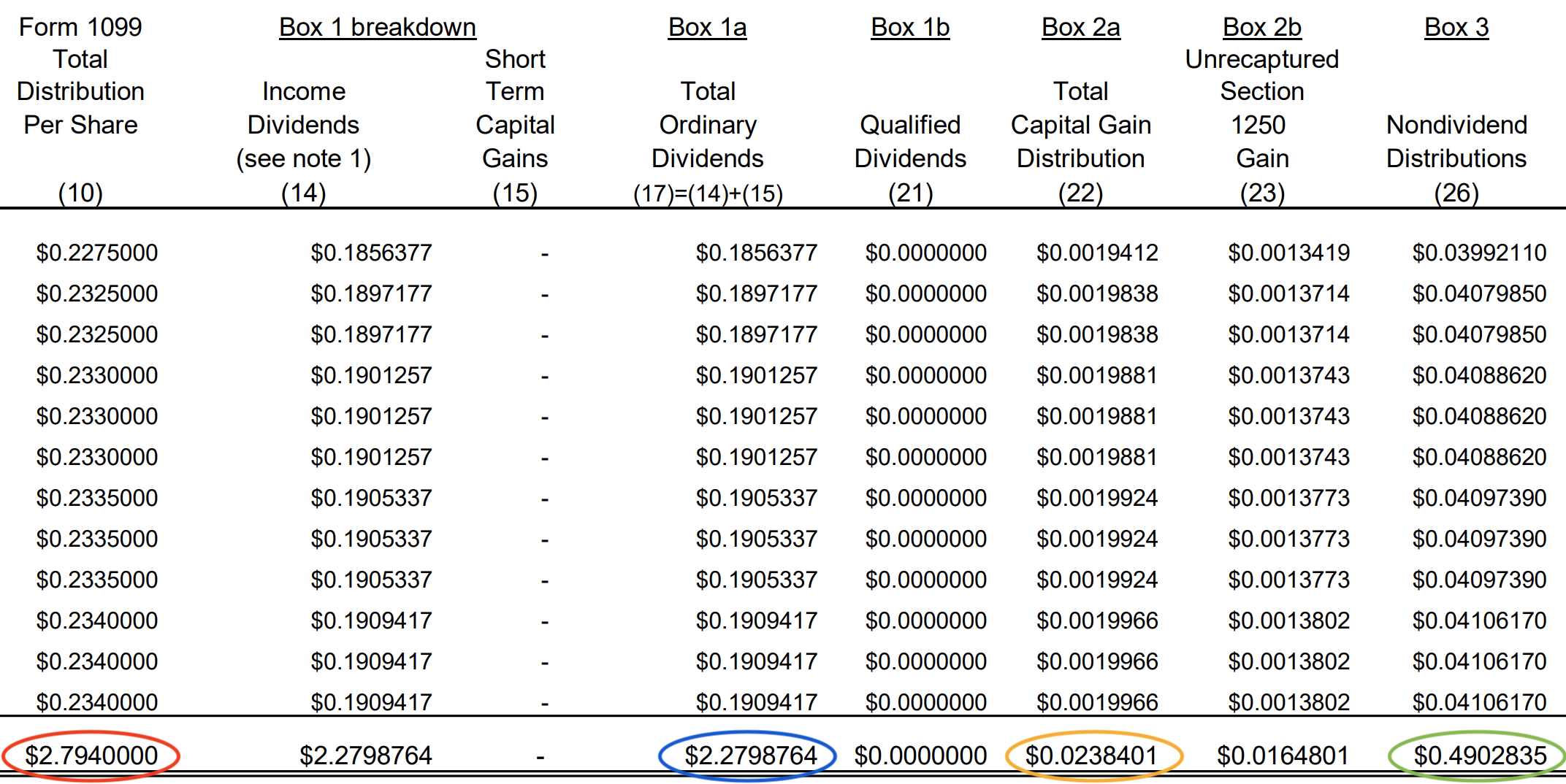

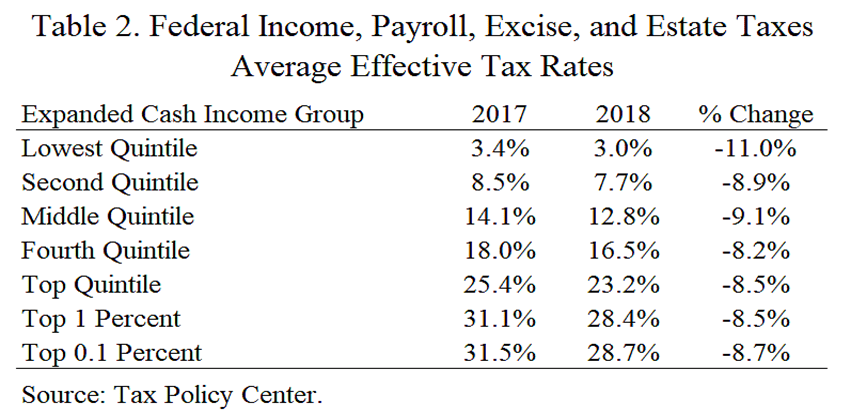

Form 1099-DIV is issued to persons who have been paid. Because public REITs are priced so high yields are much lower than Private REITs. Tax Advantages of REITs.

Discover why thousands of investors have chosen to invest with CrowdStreet. Ive evaluated many private REITs and. Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds.

Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace. Ad From Fisher Investments 40 years managing money and helping thousands of families. Subsequent changes to the regime have been designed to make the REIT more attractive the most recent being the relaxation of certain of the REIT conditions made by Finance Act 2022.

Specifically tax-exempt and foreign. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. As a result a REIT provides tax advantages to many investors over a partnership.

Dont Settle for the Same Old Fixed Income. Which one is best for you depends on your goals and your investment potential. Explore the Tax-Exempt Bond Fund of America.

A Comparison of REITs vs. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. If the REIT held the property for more than one year long-term capital gains rates apply.

The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. But if you paid 100000 for that same investment you are getting a 2 yield.

Form 1099-DIV is issued to persons who have been recieved. However this is not an apples-to-apples comparison. REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity.

This is one of the most significant tax advantages of investing in a REIT. Created with Highcharts 822 90 100 92 2019 2020 2021. 848 for the SP 500 over the same time period.

For example the MSCI REIT index which tracks REIT performance has returned 927 since January of 1990 vs. Ad We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. BREITs Return of Capital ROC 1.

To classify as a REIT the company must. Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency. The second way is to purchase shares of a non-traded or private REIT.

In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. 115-97 made it less desirable to classify advisory fees and other investment expenses as Sec. The income is only taxed at the investors hands not at the company level.

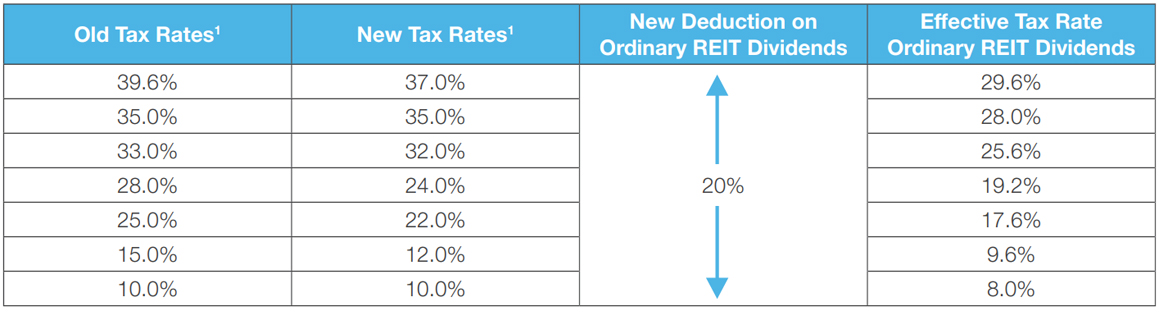

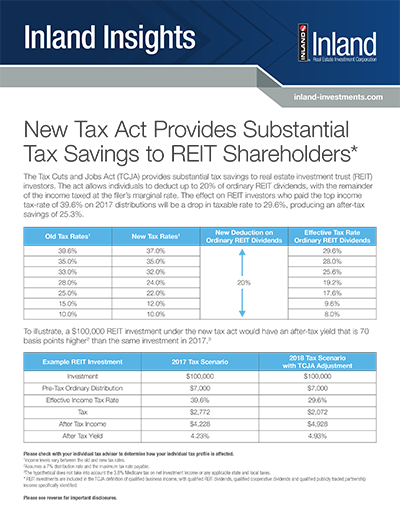

A huge accelerator of returns is. The law known as the Tax Cuts and Jobs Act TCJA PL. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units.

Earn at least 75 of its income from rental income or. Public and private REITs function. BREIT is structured as a Real Estate Investment Trust REIT and.

Heres my two cents on private REITs. In comparison to REITs private real estate investing is a much broader category that entails creating financial returns. With a Real Estate Investment Trust the investor is invested in a convertible stock certificate unlike the private equity investment that makes the investor a.

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1. Private Real Estate Investing. Common reasons for using a private REIT include --tax planning for international investors minimizing.

Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. From a tax perspective they offer benefits that are similar to those of public REITs.

The top 2 best private REITs for investors are Streitwise and RealtyMogul. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Meanwhile real estate assets have grown at 2-3 annually seemingly giving an advantage to REITs.

In their simplest tax form a REIT functions like a hybrid of the two and provides the best. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while.

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Link Flex Coworking In Austin Texas Shared Office Space And Private Office Space Available Commercial Real Estate Private Office Space Shared Office Space

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Sec 199a And Subchapter M Rics Vs Reits

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

The Best Lazy Portfolios For Wealth Building Investing Mutual Funds Investing Basic Investing

Restricted Stock Learn Accounting Finance Investing Accounting Basics

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Guide To Reits Reit Tax Advantages More

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Read This Before Investing In Reits Seeking Alpha

Guide To Reits Reit Tax Advantages More

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments